|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

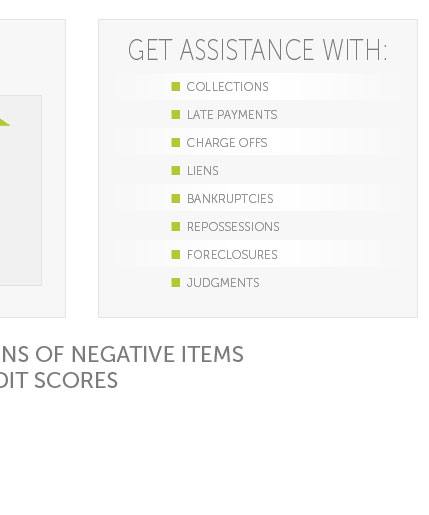

Unlock your financial freedom with our unparalleled credit repair services, designed to repair your credit score fast and put you on the path to success-because we believe that a brighter financial future shouldn't be a distant dream, but a reality that starts today; with our expert team by your side, experience swift, effective results and reclaim control over your financial destiny, empowering you to achieve the life you've always envisioned.

https://www.cnbc.com/select/how-to-boost-your-credit-score-fast/

1. Pay down your revolving credit balances - 2. Increase your credit limit - 3. Check your credit report for errors - 4. Ask to have negative entries that are paid ...

1. Pay down your revolving credit balances - 2. Increase your credit limit - 3. Check your credit report for errors - 4. Ask to have negative entries that are paid ...

https://www.youtube.com/watch?v=CmcLlJ5SWWI

FIX Bad Credit Today https://bit.ly/3s83hUz Find Your Perfect Credit Card https://https://bit.ly/4hHbBPV Ready to boost your credit ...

FIX Bad Credit Today https://bit.ly/3s83hUz Find Your Perfect Credit Card https://https://bit.ly/4hHbBPV Ready to boost your credit ...

https://www.lendingtree.com/credit-repair/how-to-improve-your-credit-score/

1. Check your credit report for errors - 2. Prioritize paying on time - 3. Work to pay down your debts - 4. Become an authorized user - 5. Request a ...

1. Check your credit report for errors - 2. Prioritize paying on time - 3. Work to pay down your debts - 4. Become an authorized user - 5. Request a ...